February Gold Prices Just Hit Differently

January has delivered one of the strongest price environments we’ve seen in recent months, and for anyone holding gold jewellery, bullion, or coins, this moment matters.

Gold doesn’t move on hype. It responds to global pressure, inflation concerns, currency volatility, geopolitical uncertainty, and shifting investor behaviour. When those forces align, prices spike. And right now, they’ve aligned.

Why Gold Prices Are So High Right Now

Over the past year, gold has steadily gained momentum. Investors worldwide continue to view gold as a safe store of value in uncertain times. When interest rate expectations start changing and global markets remain fragile, capital tends to flow into assets with long-term credibility, and gold remains at the top of that list.

For gold jewellery owners, this isn’t just financial news. It’s a real-world opportunity. High market prices directly affect what your gold is worth today, regardless of what you paid for it years ago.

That distinction is very important.

The Price You Paid vs the Value Today

Many people still associate value with receipts, brand names, or emotional attachment. In reality, gold value is determined by four things only:

- Purity

- Weight

- Current market price

- Demand

When the gold price rises, those factors work in your favour. Even older or broken jewellery can suddenly hold far more value than expected, not because it changed, but because the market did.

At Gold & Finance our highly trained team understands how the gold market works, allowing us to assess your jewellery accurately and offer fair, honest valuations based on today’s prices.

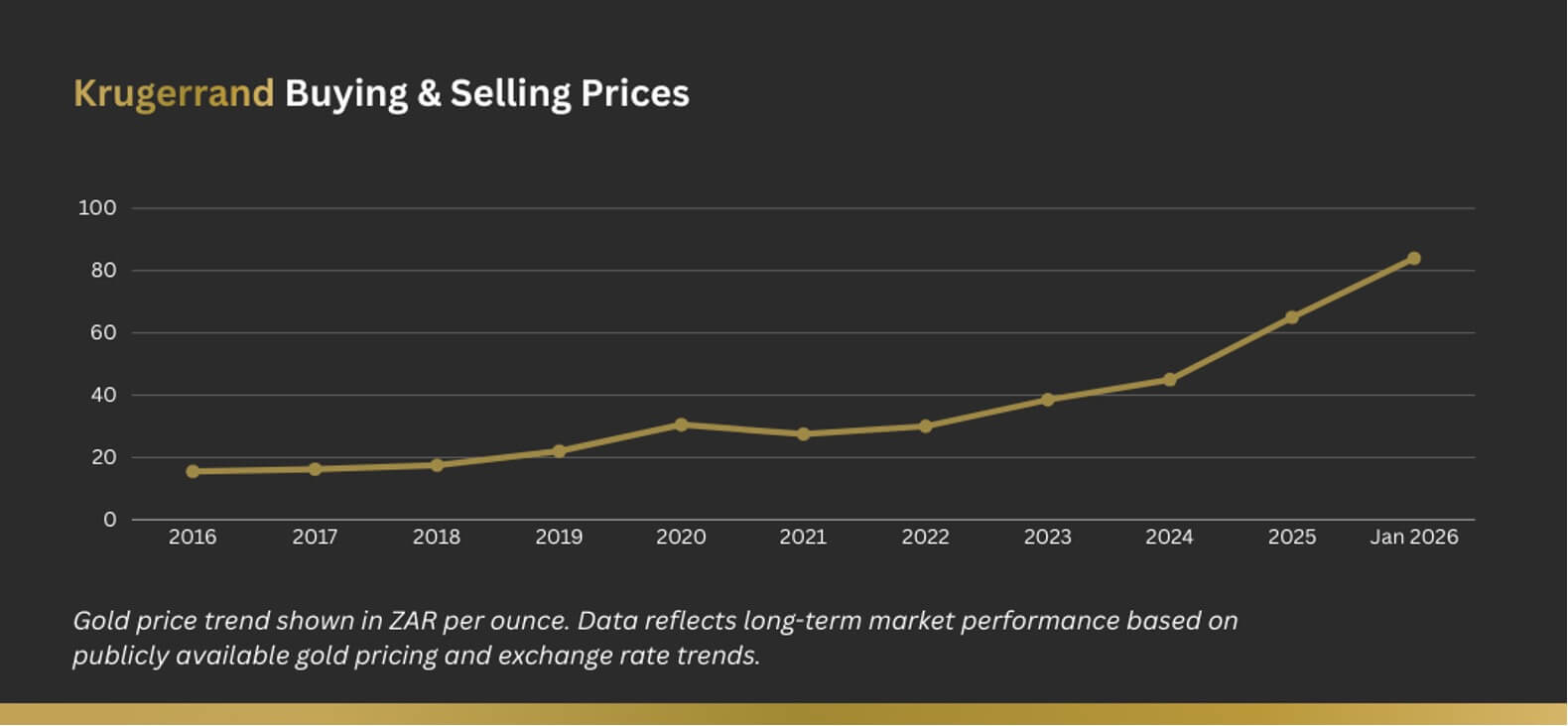

Gold Price Performance: The Last 10 Years

To put things into perspective, the graph below shows how gold prices have trended over the past 10 years. While there have been normal short-term fluctuations, the overall direction has been clearly upward, with recent months showing even sharper movement.

This is why timing matters.

Gold markets don’t announce peaks in advance which makes it even more important to stay informed about the market performance. The difference between selling during a spike and waiting too long can be meaningful.

Note: Chart is illustrative and intended to show trend direction over the last year.

Source: https://goldprice.org/

What does this mean for You?

If you’ve been holding onto gold jewellery, coins, or bullion “for later”, now is the time to at least understand what it’s worth in today’s market. Professional testing and transparent valuation ensure you’re working with facts, not assumptions.

You don’t need to sell impulsively. But staying informed protects your money. Informed decisions always start with knowing where the market stands.

Follow Gold & Finance to stay on top of market trends.